child tax credit 2021 portal

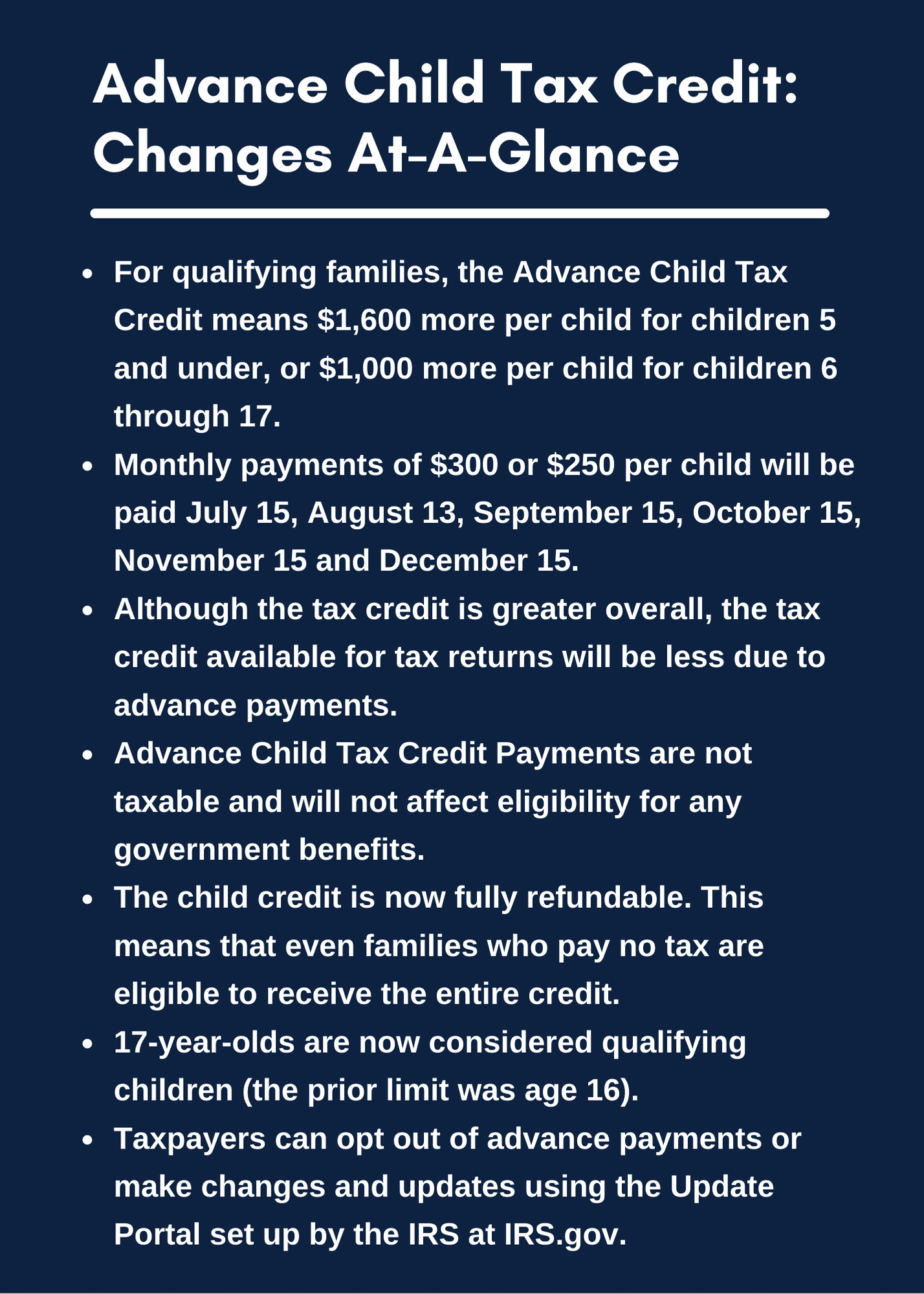

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. The full child tax credit for 2021 is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month.

Update 2021 Child Tax Credit Direct Deposit Information Irs Updates Child Tax Credit Portal Youtube

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

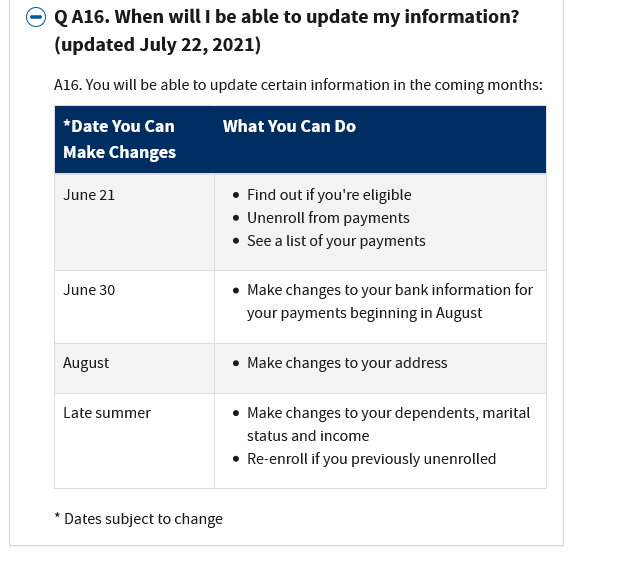

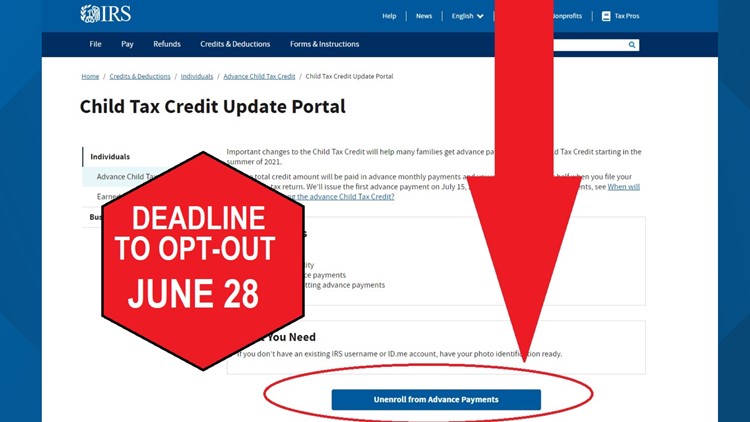

. For 2021 eligible parents or guardians. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. The Child Tax Credit Update Portal is no longer available.

You can receive payments every. The credit was expanded when the American Rescue Plan was signed into law last month and increased the credit from 2000 per child to 3000 for each child aged 6 to 17 and 3600 for. Individual Income Tax Attorney Occupational Tax Unified Gift and Estate Tax Controlling Interest.

Those who are not eligible for the higher amounts can. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. A childs age determines the amount.

2021 Tax Filing Information Get your. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. IRS Child Tax Credit Update Portal at irsgov.

Half of the money will come as six monthly payments and half as a 2021 tax credit. That total changes to 3000 for. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The American Rescue Plan Act which was passed in March 2021 temporarily expanded and enhanced the Child Tax Credit. The deadline to sign up for monthly Child Tax Credit payments is November 15. Learn about the child tax credit which will help you to claim tax credit for children under the age of 18.

After that families can still claim the 2021 CTC but will need to file. The IRS will pay 3600 per child to parents of young children up to age five. To reconcile advance payments on.

15 July Age of Child in 2021 Monthly Payment July-December 2021 Lump-Sum Payment 2022 Tax Refund 05 Up to 300 per child Up to. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The new Child Tax Credit Update Portal allows.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. The expanded Child Tax Credit CTC for 2021 was a part of the American Rescue Plan Act ARPA signed into law by President Biden to get pandemic cash assistance to more families.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. 1200 in April 2020. On July 15 2021 certain taxpayers will begin receiving the first.

And up to 250 per month per child ages 6 to 17. In addition to missing out on monthly Child Tax Credit payments in 2021 a failure to file in 2020 could mean. COVID-19 Stimulus Checks for Individuals.

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Irs Child Tax Credit Is The Web Portal The Best Way To Apply What Other Options Do I Have As Usa

Advanced Child Tax Credit Payments Miller Verchota Cpas

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

How To Opt Out Of The Advance Child Tax Credit Payments

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Get Set To Get Your Monthly Child Tax Credits By Clare Herceg Let S Get Set Medium

About The 2021 Expanded Child Tax Credit Payment Program

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Irs Child Tax Credit Is The Web Portal The Best Way To Apply What Other Options Do I Have As Usa

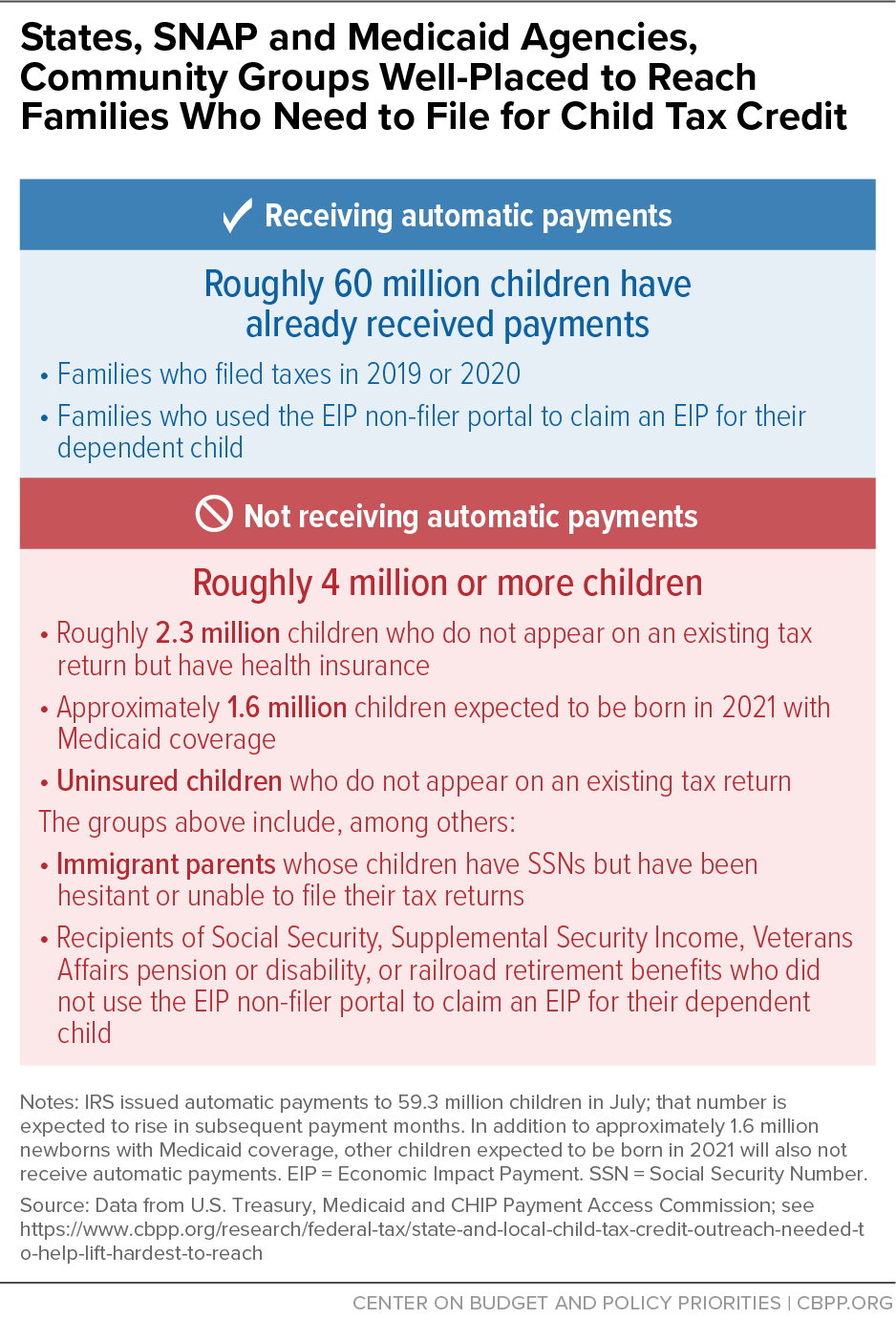

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Status Of Child Tax Credit Where Is It Do You Want It

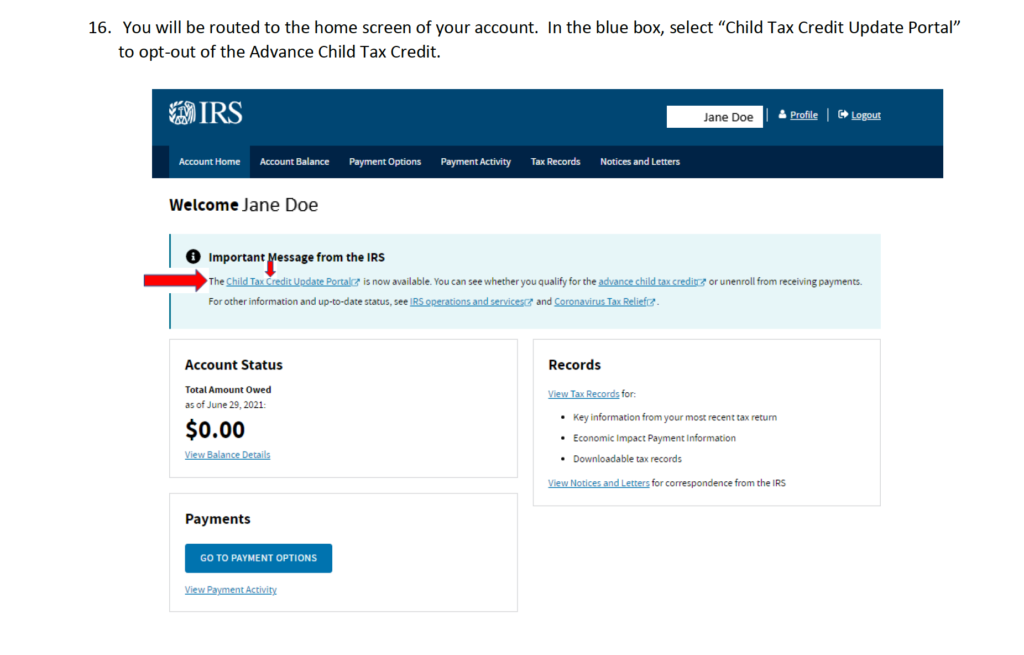

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

Child Tax Credit Payments Unenrollment Process Lupe Ruiz

Income Update Feature Debuts Nov 1 On Irs Child Tax Credit Portal Don T Mess With Taxes

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

Training Becoming A Ctc Navigator And Non Filer Ctc Update Portals Walk Through Get It Back